The extra break was granted because April 15 is a Friday this year and Washington, D.C., will celebrate Emancipation Day on that Friday, which pushes the deadline to the following Monday for most of the nation. (Due to Patriots Day, the deadline will be Tuesday, April 19, in Maine and Massachusetts.)

8 tax apps for filers on the go

From organizing your receipts to filing your return, these 8 apps will help you through every step of your tax-filing journey.

GET ORGANIZED

App: Shoeboxed

Before you can even think about filling out tax forms, you need to get organized.

Instead of stuffing receipts in a shoebox throughout the year, you can simply take photos of them and store them in an online account using the "Shoeboxed" app.

With the free version, Shoeboxed will transfer this information for you automatically for the first five receipts. For any receipts beyond that, you either have to manually enter the data or pay a monthly fee starting at $9.95 if you want Shoeboxed to continue uploading your data automatically.

TRACK DONATIONS

App: iDonatedIt

When it comes time to write off charitable donations on your tax return, you can't just guess. If the IRS comes knocking, you'll need proof that you donated your old couch to the Salvation Army and what it was worth.

iDonatedIt, an iPhone app created by a group of certified public accountants, helps you keep track of the items you've given to different charities, and even estimates the value of those items based on their condition and other factors. It also lets you snap photos to store for your records.

The app costs $2.99 for unlimited use and is available on iPhones and Androids.

FIND CREDITS

App: EITC Finder

The Earned Income Tax Credit, which gives up to $5,700 to workers earning income under $49,000, is one of the most commonly overlooked credits. The IRS estimates that one in five qualified taxpayers overlook this credit, even though it could put a lot of extra money their pockets.

To help more taxpayers take advantage of this credit, tax software developer Intuit has created a free app for iPhones and Android smartphones that allows you to enter basic information about your tax situation -- like your income, filing status and number of dependents -- to determine whether you qualify for the credit. If you're eligible, the app calculates just how much money the EITC will bring you.

PREDICT THE PAYOFF

App: TaxCaster Mobile

Need a little motivation to get your taxes done? This app will quickly estimate whether you're owed a refund this year and how fat the check might be.

Just enter some basic information, including your income and deductions, and the app will calculate your refund -- or the taxes you might owe.

The TurboTax app is free to use and can be downloaded on iPhones and Androids.

TIME TO FILE!

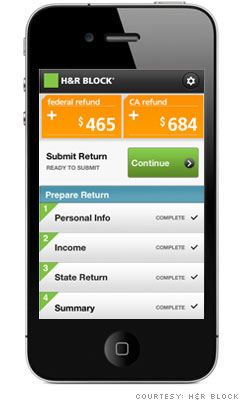

App: H&R Block At Home 1040EZ

When you finally have everything organized, you can file your taxes straight to the IRS without going to a preparer or even using a computer.

Just take a photo of your W-2 with your smartphone, and your data will be uploaded into the application. You then simply review the form, enter some basic information about yourself and you're ready to e-file.

The app, which launched in January, is available for iPhones and Androids and is free to use through April 17. The company will begin charging a filing fee after the April 17 deadline. TurboTax has a similar app that lets you file your taxes by taking a photo with your phone, but it costs $24.99.

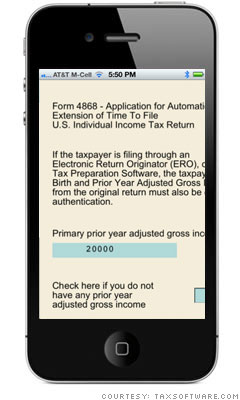

STILL NOT READY? FILE FOR AN EXTENSION

App: Form 4868 Extension

If you don't think you're going to get your taxes filed on time, you can even file for an extension through your iPhone.

Simply fill out the necessary information, and the app plugs it into the form. When you press "send" your extension application is submitted to the IRS. The IRS will then e-mail you directly to let you know whether your request was approved -- typically within minutes.

Just don't wait too long. Extension applications must be submitted before the tax deadline, which is April 17 this year.

WHAT DOES ALL THIS TAX JARGON MEAN?

App: Dictionary of Tax Terms

If you have a question about a tax term while filing your return, you can find definitions to all kinds of jargon using the Dictionary of Tax Terms app.

Not sure what "amortization" or "depreciation" means? Or are you wondering what a certain form is used for? Plug in any tax-related word you're stumbling on and get a definition immediately -- no Internet connection required.

The app, which holds more than 600 words and definitions, was created by a business professor at California State University and is available on iPhones and BlackBerries.

But since it costs $2.99 to download, make sure you're going to be putting it to good use. Other apps, like the H&R Block Mobile app, have glossaries that can be used for looking up common tax terms for free.

IS MY REFUND ON THE WAY?

App: IRS2go

You're done the painful part, now you just have to wait for your refund to arrive.

If you get antsy, download the IRS's free app, IRS2go, to see if the IRS received and processed your return. If it has, the app will tell you when you should expect to receive your check.

The app, which is available on iPhones and Androids, also allows you to sign up for tax tips via e-mail. And new this year, you can use the app to request a previous tax return. The IRS will mail it to you within several business days.

Source: http://money.cnn.com/

Theresa Todman, Managing Partner/CEO of B&M Financial Management Services, LLC . Theresa specializes in bookkeeping, accounting, QuickBooks solutions, small business tax issues and consulting.

No comments:

Post a Comment